Michael Cordes

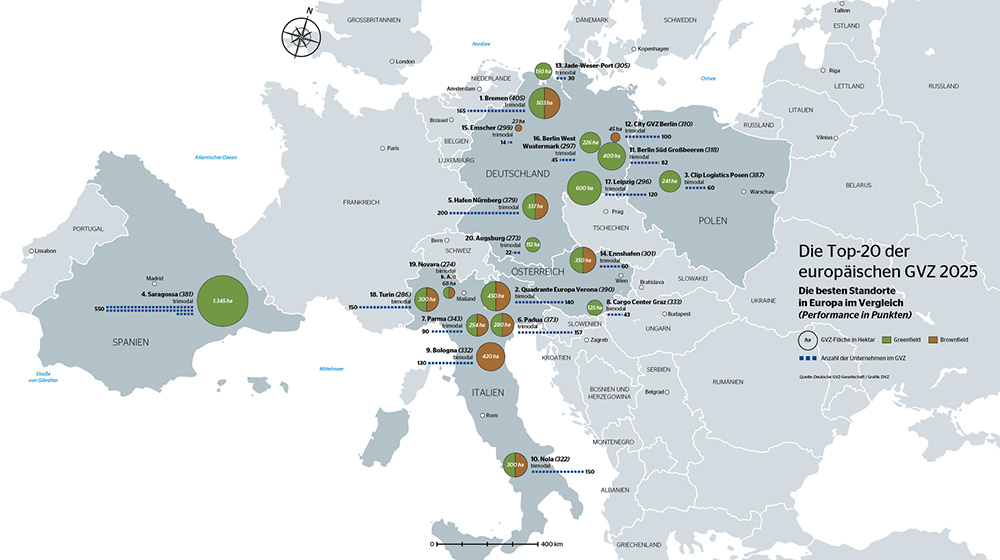

In football, the European champion is decided every four years. In contrast, the freight village ranking determines its European champion every five years. That is not the only difference: in football, Germany last stood at the top of the podium in 2013 (women) and 1996 (men). In the GVZ discipline, however, the 2025 winner, as was the case last time in 2020, comes from Bremen, and thus from Germany.

But unlike in football, it is not nations that compete here, but individual locations. And the authors of the ranking do not see the ranking as a competition between them. “Rather, we want to highlight positive examples and list measures from which other locations can learn,” says Thomas Nobel, managing director of the German GVZ Association and co-author of the ranking.

There were a few changes to this year’s evaluation. Almost a third of new questions were added. Their weighting (the questions are weighted using a points system) was also changed.

The winner of this year’s edition – the Bremen GVZ – is one of the beacons in Europe. It was the first in Germany and is also one of the largest. Is size decisive for being at the top of the ranking? “It makes it easier, at least,” says Nobel, “because large freight villages are able to offer diverse and attractive services. This makes it possible to convince even companies with high added value to locate there.”

The Bremen GVZ achieved 405 out of a maximum of 442 possible points. “Because it was founded so early, it has a head start in terms of development,” says Nobel. It also stands out for its high level of commitment to research and development projects. “This makes it a pioneer in the implementation of projects for autonomous and automated driving,” says the GVZ expert. The location is also ahead of most others in the use of photovoltaics for electricity generation. ” , these are good conditions for supplying charging stations for electric trucks with electricity, for example,” says Nobel.

In second place in the ranking is another “old acquaintance”, the GVZ Quadrante Europa in Verona. The location also took second place five years ago. “When it comes to terminal structure, transhipment and all the things related to rail connections, Verona is the benchmark for Europe,” emphasises Nobel.

Third place goes to the GVZ Clip Logistics in Swarzedz near Poznan. “We are seeing very dynamic development here,” says Nobel. In 2020, it was already in sixth place, but now the Poles have worked their way even further up the rankings. “The management has succeeded in establishing modern logistics facilities. As a result, a textile retailer, for example, has set up shop there, processing fashion items and distributing its goods from the GVZ. The number of employees is correspondingly high,” says Nobel, impressed by the development.

How the ranking is determined

The team of authors led by Bianca Nobel (project assistant at To-be-now-Logistics-Research-GmbH), Stefan Nestler and Thomas Nobel (both managing directors of the German GVZ Association, DGG) compiles the European ranking every five years. One focus is on the GVZs in the member countries of the European GVZ umbrella organisation “Europlatforms”, which accompanies the study. A total of 230 locations were included in the (preliminary) selection. This year’s survey of freight villages comprises around 15 clusters of questions covering 50 evaluation criteria. The number of criteria has increased by a third compared to the last survey, which is why a comparison with the 2020 results is only possible to a limited extent.

In addition, the evaluation criteria are weighted according to their importance on a scale of 1 to 6: for example, the current number of employees is assigned a very high value, which is then multiplied by the score for the respective freight village (between 0 and 3). Special points were awarded again for “best-in-class rankings” and outstanding scores. A total of 442 evaluation points could be achieved. Bremen, as the number one, is the only freight village to have exceeded the 400-point mark. So there is still room for improvement. For further information on the ranking, interested parties can contact the DGG. You can find more information at: www.gvz-org.de

Italy dominates the top ten

The performance of the Italian locations is striking in the ranking. Five of them have secured a place in the top ten. “We were surprised that so many Italian freight villages have established themselves so far ahead,” says Nobel. He and the co-author of the ranking, Steffen Nestler, visited several locations in Italy last autumn. “We noticed that a lot has happened in the important area of intermodality,” he says, describing his impressions. Most of these are established locations that were created early on, developed appropriate structures and are now continuing to develop at a high level. “Padua, for example, uses fully automated cranes. The organisation of truck entrances and exits is also automated,” says Nobel. The automation of gate areas can also be observed in other Italian freight villages. There are several lanes through which trucks can enter and exit the freight village.

German and Italian locations dominate the top 20. This is because the ranking focuses primarily on locations in countries that are members of the Europlatforms organisation. This enables the authors to ensure a high-quality response rate to the questionnaires.

Nine freight villages from Germany have made it into the top 20. Only Cargo-Center-Graz, Ennshafen (both in Austria), Clip in Poland and the Zaragoza freight village in Spain are not from Italy or Germany. Five years ago, the locations Barcelona (Spain), Budapest (Hungary) and Kouvola (Finland) were also represented.

Even though there have been some new criteria in the assessment of freight villages, intermodality remains “the DNA of freight villages,” as Nobel puts it. This is also a prerequisite for participating in the ranking at all. If a location does not have a photovoltaic system, points are deducted in the assessment. However, the possibility of transferring goods from road to rail or inland waterway must be available. Artificial intelligence (AI) was used to identify suitable freight villages, using aerial photographs to determine the extent to which the transport connections and the location with its facilities met the respective criteria.

Infrastructure causes concern

The authors also asked about potential risks. “This year, it was striking how often the condition of the transport infrastructure was mentioned as a cause for concern,” says Nobel. This was the case for both rail and road transport and across all countries. “That wasn’t the case five years ago,” notes Nobel.

Climate neutrality is not yet an explicit criterion in the assessment: “There’s no question,” says Nobel, “that the issue of avoiding CO₂ emissions is becoming increasingly important.” And it is already taken into account in the assessment under the umbrella term ESG criteria. However, it is still very difficult to measure the emissions of a freight village. “Companies are already struggling with this, when I think of the debate about Scope 1, 2 and 3,” says Nobel. And larger freight villages often have 100 or more companies. Obtaining an exact calculation of CO₂ emissions from all of them is virtually impossible today. However, he is certain that the issue is gaining in importance and will play a greater role in the next survey.

This is where he is also counting on the possibilities offered by AI. In five years’ time, for example, it could be much better at recording traffic flows and the associated CO₂ emissions. In addition, AI could possibly provide information on the employment effects in downstream areas that is not yet available today.

The way locations present themselves to the public, on the internet or on social media, is also becoming increasingly important. This includes activities such as open days, social engagement or communication via channels such as LinkedIn. “This is a development that was insignificant five years ago and will certainly become more important in the next evaluation in five years’ time,” predicts the GVZ expert.

Do you have a special request?

Contact us if you would like to learn more about the efficiency of German logistics!